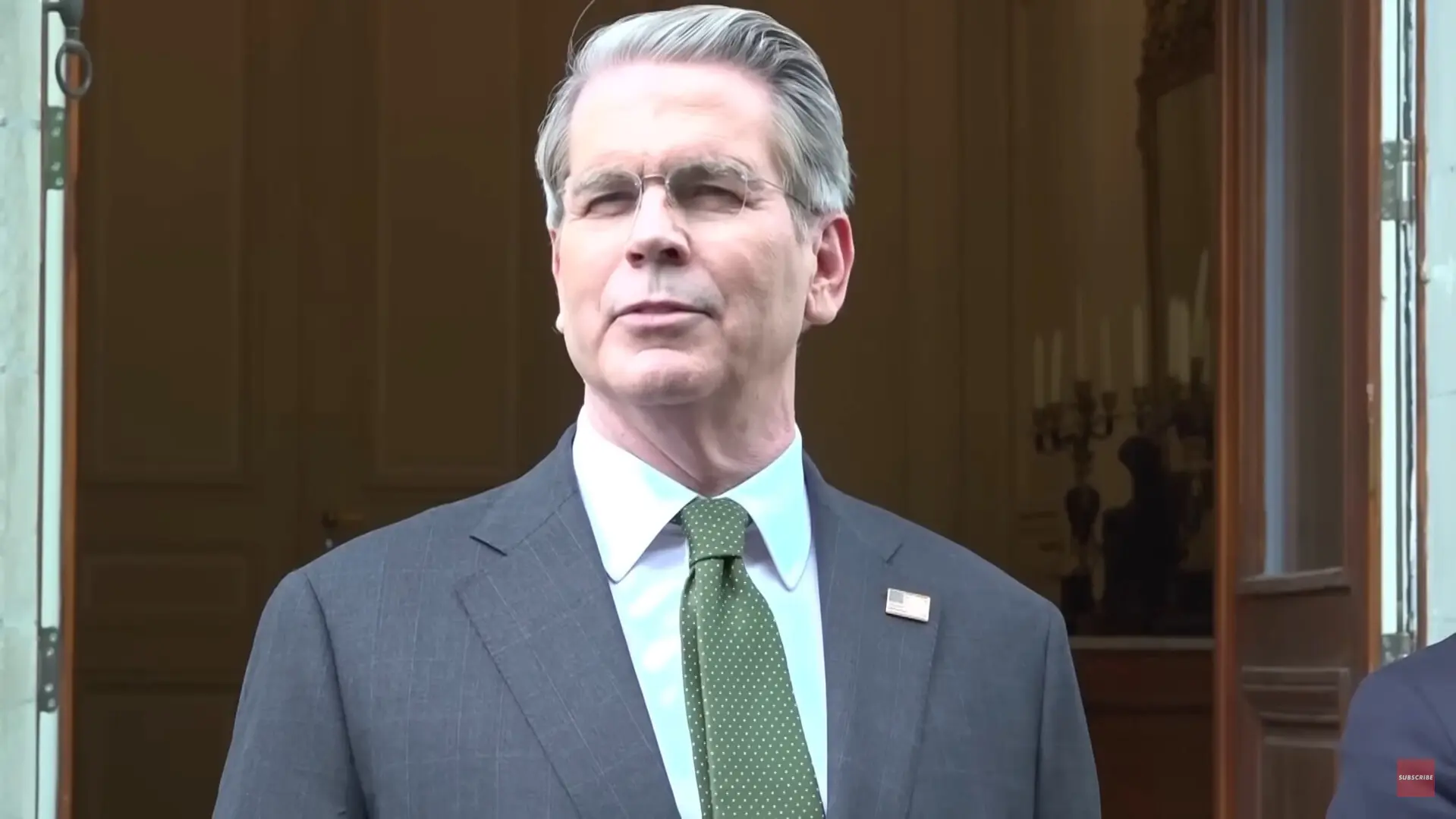

U.S. Threatens Higher "Reciprocal" Tariffs as Trade Deals Hang in the Balance, Warns Bessent

Treasury Secretary Scott Bessent stated on Sunday that the U.S. will reinstate significant "reciprocal" tariffs if trading partners fail to enter into new deals during a 90-day truce, indicating increased pressure from President Donald Trump on international governments.

On CNN’s "State of the Union" program with Jake Tapper, Bessent appeared said The administration has warned them that tariffs will increase again to the levels from April if negotiations fall through. He noted that eighteen "key" allies are central to this discussion; however, he didn’t specify when these increased rates might be reinstated.

Bessent proposed that certain agreements could have a regional focus, suggesting that authorities might establish a single shared target for "Central America" or "this section of Africa." Meanwhile, she indicated that less extensive bilateral relationships might just be assigned a predetermined numerical value.

After President Trump initiated a 90-day countdown following his directive for a provisional withdrawal from the extensive tariffs announced on April 2nd—a date he referred to as "Liberation Day"—the situation evolved. Initially, these measures included so-called "reciprocal" charges which were subsequently adjusted to a standard rate of 10%, all within ongoing negotiations.

On Friday, at a business roundtable in Abu Dhabi, Trump cautioned that "the clock is ticking."

Over 150 nations wish to engage in discussions, he mentioned, yet the administration can’t accommodate every single one. In "two to three weeks," according to Trump, Bessent along with Commerce Secretary Howard Lutnick will begin dispatching letters detailing "the fees they'll incur for conducting business within the U.S." He assured that this procedure would be conducted in a manner that is "highly equitable."

Shares surged on Monday following comments from Bessent and U.S. Trade Representative Jamieson Greer disclosed In Geneva, there was a brief easing of tensions in the trade dispute with China. The U.S. reduced tariffs on Chinese imports from 145% to 30%, while China lowered its levies on American products from 125% to 10%. Last week, the S&P 500 surged by 5.3%, marking five consecutive days of increases.

The U.S. relies on 'strategic ambiguity' to negotiate more favorable terms.

The ongoing fluctuation in tariff levels has kept U.S. companies on tenterhooks. Regarding the abrupt change in rates, Bessent characterized the administration’s strategy as "strategic ambiguity." According to him, offering excessive clarity could allow other nations to manipulate the talks. He forecasted that once the haggling concludes, "merchants, the general public, and laborers within America will reap greater benefits."

Smaller enterprises depending on Chinese supplies express worry that increasing expenses and ambiguous regulations disrupt their investment strategies.

Bessent informed CNN that he anticipates trade for the type of products these companies require will proceed "with reduced tariffs," although numerous proprietors worry they might still need to increase their pricing to safeguard their profit margins.

Bessent verifies that Walmart will cover certain tariffs whereas passing the remaining costs onto customers.

Walmart Recently informed customers about potential price increases. On Saturday, the president responded on Truth Social, encouraging the chain to "absorb the tariffs."

Bessent mentioned that he communicated directly with Walmart CEO Doug McMillon on the same day. "Walmart will bear some of the tariff costs," the secretary stated, also noting that "a portion might still be transferred to customers."

Moreover, rating agency Moody’s On Friday, they downgraded the U.S. sovereign rating by one step to Aa1, removing the final AAA status that the nation had retained.

In 2023, Fitch downgraded its rating, and S&P followed suit in 2011. Moody’s cited America’s $36 trillion debt along with the political gridlock surrounding a White House budget proposal, which the Committee for a Responsible Federal Budget projects could increase the deficit by an additional $3.3 trillion over the coming ten years.

Bessent minimized the impact of the downgrade. "I don’t attach significant weight to what Moody’s says," he said to CNN. Nonetheless, a reduced rating might lead investors to seek higher returns on Treasury securities, which could increase borrowing expenses affecting mortgage rates as well as global contractual agreements.

Academy: Looking to increase your wealth in 2025? Discover how you can achieve this through DeFi in our forthcoming web class. Save Your Spot

Post a Comment for "U.S. Threatens Higher "Reciprocal" Tariffs as Trade Deals Hang in the Balance, Warns Bessent"